How a Silent Insurance Error Cost Me Thousands Over Years

2025-04-27On the Fragility of Automation, Big Data, and AI

The insurance industry markets automation as a force for efficiency. But when said automation introduces an error, that error can propagate silently across systems, damaging consumers without warning, accountability, or remedy. This is my experience.

In 2020, after a catalytic converter theft here in San Francisco, my insurer (Metromile, now part of Lemonade) incorrectly flagged my car internally as a total loss—despite paying for repairs and leaving my DMV title clean, without ever informing me.

The clerical error quietly spread through standard valuation databases like CCC One, DCI Valuation, and Experian AutoCheck, affecting valuation feeds across the industry, starting with Metromile and Lemonade. There was never any human or AI review or correction.

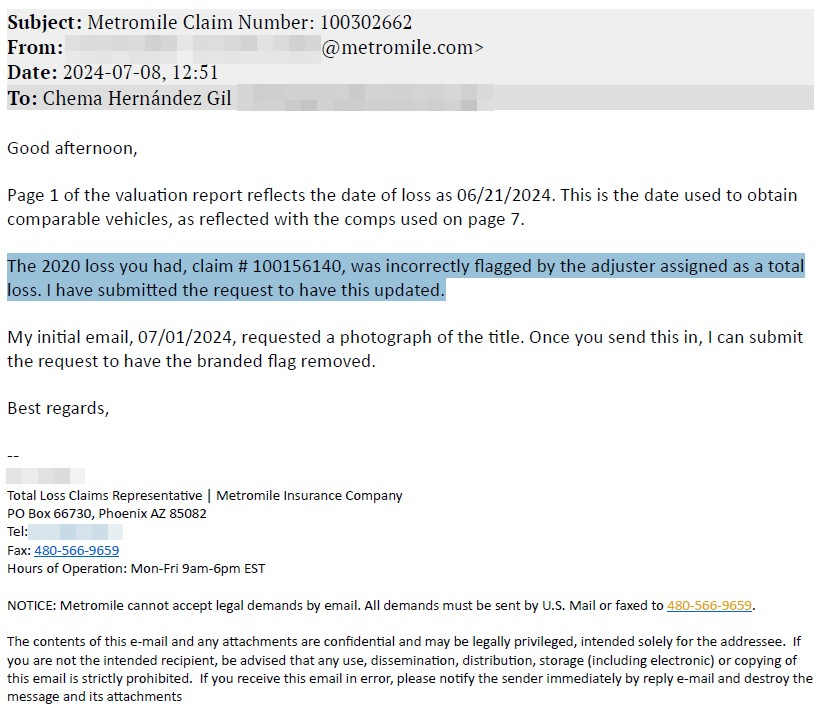

I only discovered the insurance claim error after a hit-and-run collision at Brannan and 6th in SoMa, San Francisco, in June 2024, when my uninsured motorist claim valuation came back unexpectedly low. When I challenged the valuation—while recovering from injuries—Metromile eventually admitted:

“The [February] 2020 loss you had, claim #100156140, was incorrectly flagged by the adjuster assigned as a total loss.”

By then, the financial damage was done:

- Insurance rates more than doubled despite minimal driving.

- Competing insurers either refused coverage or offered unaffordable quotes.

- Valuations were repeatedly reduced by up to 50%.

Across three separate claims between 2020 and 2024, no one—human or AI—at Metromile or Lemonade detected or corrected the error.

The incorrect flag remained embedded, silently degrading my financial standing year after year.

Automation Hype vs. Reality

When Lemonade completed its acquisition of Metromile in July 2022, it described the merger as combining “big data and AI-driven claims automation” with “customer obsession.”

In practice, the silent propagation of a single incorrect flag reveals a more dangerous reality:

Automation, without active human and meaningful regulatory oversight, creates systemic fragility, and consumers bear the cost.

I ultimately had to escalate:

- Filing a California Department of Insurance complaint,

- Demanding my full claims file under regulatory rights,

- Preparing for formal arbitration to resolve outstanding damages.

The 2024 claim, ten months later, remains unresolved.

The Broader Risk

This experience is not just about Metromile, Lemonade, or a single insurance claim error. It highlights the structural vulnerability that exists in an industry increasingly driven by automated decision-making, where even small data errors can be:

- Automatically amplified,

- Invisible to consumers and regulators,

- Immune to traditional and innovative accountability pathways.

Automation without adequate verification doesn’t just create efficiency. It calcifies mistakes and magnifies harm. If the insurance industry wants to claim the benefits of automation, they must also absorb the responsibility:

- Regular audits,

- Transparent correction processes,

- External regulatory enforcement when internal systems fail.

Otherwise, the next silent error could cost consumers years of financial harm, and they may not realize it until it’s too late.

Do you like this post? Buy me a coffee.